Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Digital infrastructure as a general asset class is where two megatrends reshaping the global economy – digitalisation and decarbonisation – both come together, presenting some tensions but also opportunities to amplify the effects of each other. Data centres are one prime example of such an asset, playing a key role in digital transformation in an exponentially more data-driven world, as well as having an important role to play in the broader energy transition due to their inherently operationally energy-intensive nature. We set out some of the contextual developments and macro-trends generally relevant for both financiers and private capital investors in data centres and we also unpack some key considerations for financiers in data centre financing transactions. In practice, the financing of data centres has drawn upon principles from several traditions of financing, and looking forward, sustainability-focused terms and considerations in data centre financings can be a potent tool in enabling the transition to a more digital, yet more decarbonised economy.

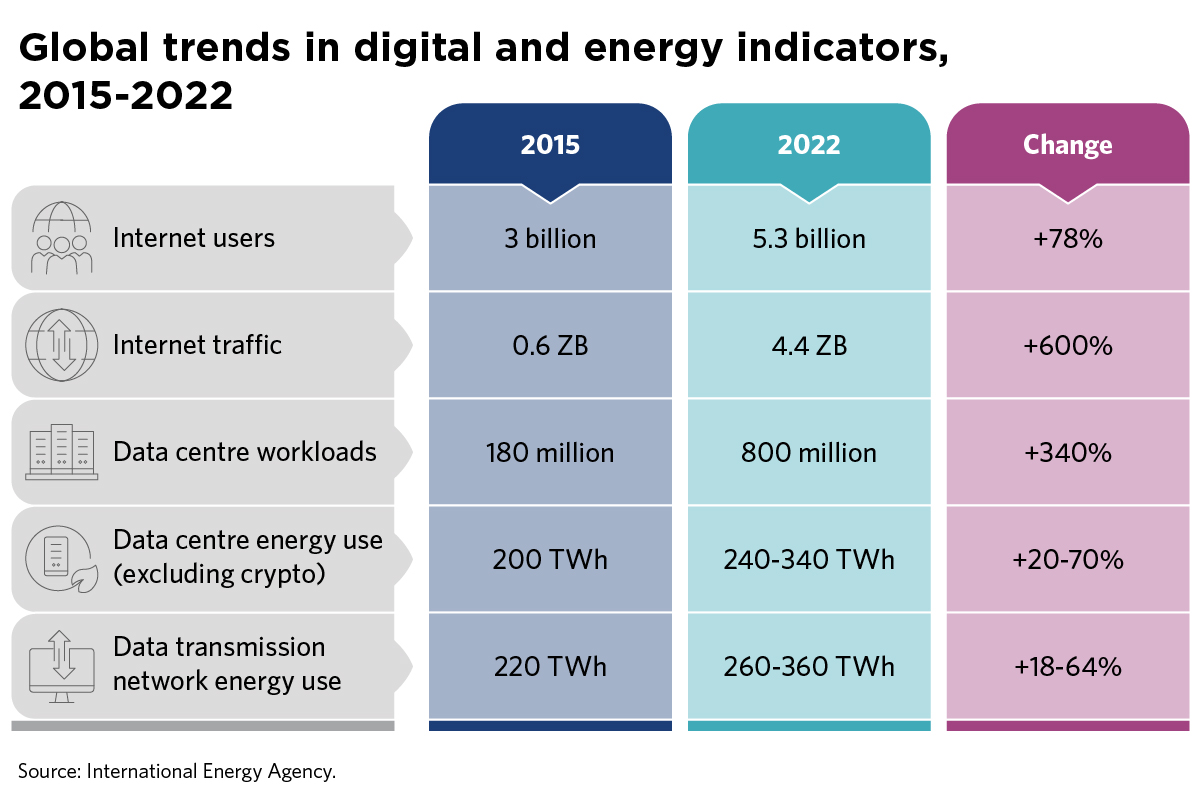

The demand for digital services is a trend that continues to grow rapidly on a global scale. Since 2010, the number of internet users across the world has more than doubled, while internet traffic across the world has expanded many times over (up to 25-fold based on some industry estimates) within that same period. The Covid-19 pandemic of recent years has only accelerated this drive; according to some industry estimates it has been noted that up to 90% of the world's data has been created in just the last two years. Other factors such as the growth in cloud computing, AI, streaming services and the 'Internet of Things' (it has been estimated there are 13 billion internet-connected devices, and this is expected to double by 2030) entail huge data requirements. All this has meant the digital infrastructure necessary to underpin and meet the demand for data services across individuals, businesses and economies– infrastructure such as data centres and data transmission assets including telco towers and fibre networks – has become increasingly critical in the move toward digitalisation. Data centres themselves being, at their simplest, physical facilities used by organisations to house business-critical applications and data, provide a network of computing and storage resources to facilitate the delivery of shared applications and data and form the foundations of this broader structural digital transformation, and as such are fast taking on quasi-utility qualities. As data centre establishment and migration is a technically complex process and demand for key locations is highly competitive, enterprise occupants of data centres usually remain at the premises for a long period, generally for more than 10 years, resulting in an asset class offering a long-term income stream.

Globally, it is estimated that the data centre market will grow at a compound annual growth rate of 6.12% between 2023 and 2028, resulting in a market volume of US$438.70 billion by 2028. In the UK, the data centre market is projected to grow from US$14.64 billion in 2023 to US$18.73 billion in 2028. Unsurprisingly, wider recognition of data centres as foundational components of the digital infrastructure ecosystem and the accompanying market demand for data centres has attracted the interest of a range of private capital investors (and their financiers), often because of the steady, predictable, and utility-like cash flows and typically risk and inflation-adjusted yields akin with other infrastructure assets. According to industry research, private equity driven M&A investment involving data centres has increased globally, accounting for over 91% of total data centre investment in 2022 with the value of M&A deals in the sector reaching US$48 billion in 2022. Earlier in 2023, Virtus Data Centres, a major digital infrastructure provider announced an investment of €3 billion in a data centre campus in Berlin, Germany, and Australia’s largest pension fund, AustralianSuper, committed to a €1.5 billion investment to acquire a minority stake in Vantage Data Centers’ operations in Europe, Middle East and Africa (a transaction on which Herbert Smith Freehills advised AustralianSuper).

Data centres, while underpinning digitalisation, are energy-intensive assets that, despite efficiency improvements in hardware and cooling, still require the consumption of a significant amount of electricity with a corresponding impact on carbon emissions. The International Energy Agency estimates that data centres account for between 1-1.5% of global electricity consumption, and together with data transmission networks are responsible for 1% of energy-related greenhouse gas emissions. In the UK, the National Grid Electricity System Operator estimates data centres currently use about 1% of UK electricity and predicts data centres will consume just under 6% of U.K. electricity by 2030.

Governments, investors, and data centre sponsors themselves are fast recognising the imperative of improving the sustainability and energy consumption outcomes of data centres. Emerging regulatory initiatives targeting this asset class highlight the tension between the digitalisation and decarbonisation megatrends represented by data centres but are also indicative of the opportunities to amplify both of these megatrends where sustainability and energy efficiency inform the growth and operation of data centres. The European Commission's Energy Efficiency Directive and Corporate Sustainability Reporting Directive actively requires data centres across the EU with a minimum installed IT capacity to report emissions to meet new corporate sustainability reporting requirements as part of the EU's stated goal of making data centres climate neutral by 2030.

Globally, as part of COP28, a coalition of more than 60 countries (including the UK and the US) have signed up to the Global Cooling Pledge, a pledge to reduce energy emissions generated by refrigeration and the cooling sector by two-thirds by 2050. This will have significant implications for sustainability practices in the data centres market given that cooling the heat generated by the servers and equipment within data centres is critical to their operation, with such cooling accounting for approximately one third of a typical data centre’s total energy consumption.

For some of our broader insights into COP28 please see the HSF Insights COP28 hub.

Sustainability concerns in the data centre market has led to close consideration not only of increased energy efficiency but also to the use of renewable energy sources, such as solar and wind power, by data centre operators to reduce carbon emissions and meet sustainability requirements either directly or through the buying of power purchase agreements (PPAs) to offset the physical use of non-renewable energy with renewable energy. Operators of hyperscale data centres such as Google, Amazon, Meta and Microsoft are among the largest corporate purchasers of renewable energy in the world.

Opportunities for increasing energy efficiency in data centres have also been demonstrated in the significant waste and excess heat from data centres being applied toward district heating of commercial and residential buildings situated nearby. Last year in the UK, for example, it was announced that 10,000 new homes as well as commercial space in the London boroughs of Hammersmith and Fulham, Brent and Ealing will use waste heat from data centres for the provision of heating and hot water.

Data centres are capital intensive assets that require significant investment, whether to enable development, operation, or acquisition. Consequently, funding data centre growth requires access to bank debt and other financing sources. Innovative solutions are often needed, with financings tailored to the specific features of data centres whether that be the widely recognised intensive energy consumption of such assets discussed above or the unique terms of the contracts with offtakers.

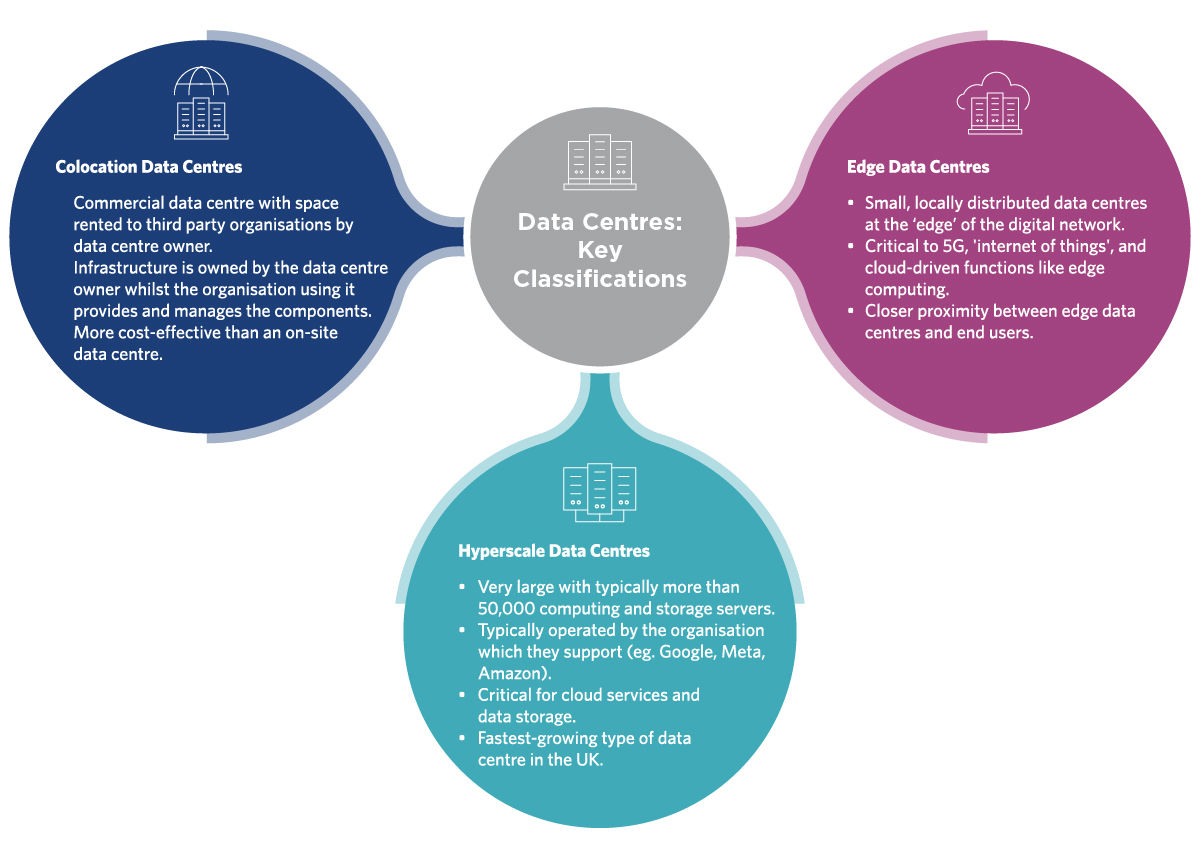

No singular, uniform approach has developed toward the financing of data centres and to the considerations that debt investors will take into account; in practice these will inevitably be a function of the features of the transaction in question including the type of data centre asset (eg, hyperscale, colocation) and the stage of the lifecycle in which the data centre is at (ie, greenfield or brownfield). Accordingly, we have seen hybrid approaches toward the financing of data centres which are based on, and borrow from, features and techniques of traditional non-recourse project financing principles, real estate finance, infrastructure and junior holdco financing, securitisation, as well as leveraged financing structures. Some of the key considerations that will be relevant across these different financing structures are explored below.

Sustainability

The energy sustainability and related ESG credentials of the data centre asset are a key focus for debt financiers of such projects, as they are for equity investors. There is a significant opportunity in sustainability focused financing to continue to enable and incentivise quantifiable improvements in decarbonisation results for data centres (whether through utilisation of PPAs and renewable energy sources and including the deployment of digitalised technologies like artificial intelligence to assist with energy efficiency and costs in data centre operations). While a formalised framework for such sustainability and ESG matters specific to data centre financings has not yet developed in market practice, financiers would be concerned with the compliance and monitoring of such matters in connection with, and complementary to, the developing regulatory landscape in this sector, including the energy and environmental matters discussed earlier in this article. Certain metrics and sustainability-related performance indicators would feed into contractual reporting requirements and financing economics. Any margin ratchet for such sustainability-linked loans will be tied to the achievement of key performance indicators that perhaps, unsurprisingly so, given the energy and water intensive operations of data centres, are often concerned with energy efficiency and water usage, as well as other metrics associated with a reduction in carbon emissions such as use of renewable energy generation. Other than financing structures incorporating sustainability-linked loans, a green bond financing structure may also be considered where the data centres to be financed satisfy the relevant use of proceeds criteria and would in most cases include some degree of impact reporting for disclosure of the allocation of funds and the quantifiable improvement of ESG impact. Given the proven interface between the waste heat generated by data centres and heating distribution and district heating applications, we would expect this to be another potential sustainability-linked area that may develop in practice and to be of interest to financiers in structuring sustainability focused finance solutions for data centres.

Revenues

In keeping with the infrastructure-like investment characteristics of data centres, the cash flows of data centre businesses usually depend on a small number of long-term, key revenue contracts or leases (and in the case of hyperscale data centres – a key revenue contract or lease with a single anchor customer/tenant). For most financiers, due diligence and some form of bankability analysis of these key revenue contracts (of matters such as the creditworthiness of the customer, and the rights of the customer to terminate or issue abatements to the sums otherwise payable to the data centre operator) will therefore be a key part of the credit profile for the financing, particularly in the case of financings tracking more closely a non-recourse or limited-recourse financing structure, where the cash flow generated by the project debt will be the exclusive means of debt repayment.

Where the financing is structured with a repayment profile featuring a balloon or bullet repayment on maturity of the financing, analysis of the term structure of the revenue contracts will be an important consideration for financiers given the refinancing risks of a balloon or bullet repayment. Similarly, key revenue contract terms expiring, or which will be subject to an option of extension, before debt maturity will be a credit risk that financiers would need to understand and require mitigation for.

As part of their security package, financiers are likely to expect (more so in a project finance-based context but also in some instances of leveraged finance) an assignment by way of security of rights of the borrower or obligor entity under the key revenue contracts. Financiers in a more non-recourse or limited-recourse financing are also likely to insist on a direct contractual relationship with the customers to the key revenue contracts through subordination, non-disturbance and attornment agreements (SNDAs) (functionally similar to tripartite agreements in project financings or non-disturbance agreements in real estate financings) by which the customer commits to its termination rights of the key revenue contract being subject to restrictions in favour of the financiers and by which financiers covenant to refrain from disturbing or interfering with the customer's use of the data centre.

Land

It would not be uncommon for data centre sponsors to own the underlying land on which the data centre is based. In cases where the land is being rented from third parties such as local governments/authorities, financiers, particularly those in a structure based on project financing would be concerned with due diligence of the rights of termination and renewal rights under the lease and in a similar way as any key revenue contracts in a project financing structure, procuring a direct contractual relationship with the landlord through a tripartite agreement. The financiers may also expect to take security over the sponsors' interest in the land, by way of mortgage or mortgage of lease. In some real estate financing structures, an OpCo and PropCo structure among the obligors to the financing would see the credit risk and financing of the PropCo entity which owns the data centre itself and the interest in the land being segregated from the OpCo entity operating the day-to-day business of the data centre.

Power supply

Given data centres are such energy-intensive consumers and beyond the resultant ESG considerations this creates power supply (and even more importantly, the uninterrupted continuity of such power supply) is critical to the delivery and operation of any data centre. Financiers, particularly those participating in project financing a greenfield data centre development, would be keen to understand the power supply contracts with third parties and how the data centre sponsor will attempt to limit their exposure to outages through any use of back-up generators and uninterruptible power supply systems, and in some cases, captive generators of renewable energy such as on-site wind or solar power. Financiers would also have an interest in the due diligence of the risks of abatement by the customers under the key revenue contracts for any outages in power, and associated risks.

Expanded capacity

Given the essential role of data centres in digitalisation and the exponential data requirements that underpin their growth, an important commercial goal often required by sponsors in data centre financings, particularly in more leveraged style financing structures, is the scope for the capacity of the data centre(s) being financed to be expanded and developed in the future. In addition to the permissibility for such transactions and activities to be undertaken under the financing, this may also be supported by the structuring of uncommitted accordion facilities to increase debt capacity to fund the capex for this purpose.

Specific financing structures

The most appropriate financing options (or combination of options) will vary with the sponsor's business, the exact nature of the data centre asset being financed and potentially the ESG and regulatory backdrop In addition to structures based at least in part on real estate financing and project financing for data centres in the greenfield development stage, some of the other specific structures seen in the market also include:

In conclusion, the momentum to both digitalise and decarbonise means that sustainability should, and will, be a major consideration for private capital investors and their financiers in a market for data centres that is only expected to expand in importance with the increasing demand for data-driven services. While the financing for data centres is expected to continue to require some flexibility as to features and to draw on considerations from different financing approaches without a singular set of principles, a function of the specific characteristics and credit profile of individual data centre businesses, sustainability-focused considerations in such transactions represent important opportunities for financiers to enable the move toward a carbon-neutral future in this sector.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs